In deregulated states, there are a couple very good reasons to evaluate your current supply plan

and switch using Choice Energy Network EVEN IF the potential rate savings isn't considerable.

1) Fixed rate vs. variable rate

All Choice Energy Network supply rates are fixed for residential and small

business customers, meaning you pay a fixed cost for energy over the time period you see listed

for each plan. (Large commercial account? Depending on your business needs and market conditions,

we can negotiate variable terms directly with suppliers.) No "act now" promotional rates. No

airline mile gimmicks. And, importantly, your rate doesn't spike due to changes in the wholesale

market.

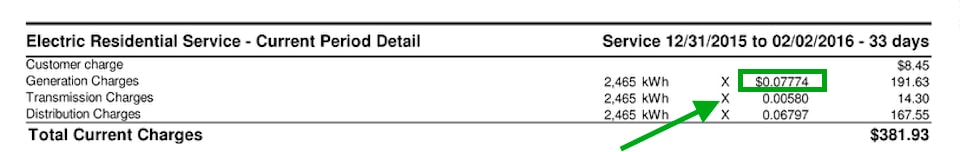

If you're not sure whether your existing plan is fixed or variable, see "[usage] kWh x [rate]"

under the Supply or Generation Charges section on your bill that shows your

current rate, and check it against past bills online (or call your local utility).

2) Going green: eco-friendly energy

Looking for clean energy options — like electricity produced by renewable resources? In many

markets Choice Energy Network has cost-effective renewable energy plans available that can help you

reduce your footprint today. What's

renewable energy?

"Going green" shouldn't have to break the bank. We're working with our electricity & natural

gas partners to bring additional green energy plans to every market we serve (see

below).